Whether SBI Smart Wealth Builder is good? Basunivesh - Forum Features of SBI Life - Smart Wealth Builder. The main features of SBI Life - Smart Wealth Builder are: The plan offers the policyholder Guaranteed Additions up to 125% of one annual regular premium on a regular premium policy, for a 30 year policy term. This is subject to the policy being in force till the maturity date.

SBI Life Smart Wealth Builder Compare Features Benefits

SBI Life Insurance Reviews Glassdoor. SBI Life Insurance Dhamtari Branch Insurance Advisors Required. 1.4K likes. Insurance Broker, This animation video explains the features and benefits of the insurance plan - Smart Wealth… SBI Life's Smart Wealth Builder on Vimeo Join.

SBI Life Insurance, a joint venture between India’s largest bank State Bank of India and the leading global insurance company BNP Paribas Cardif, is a significant player in the ULIP market. It is known for ULIP products like eWealth Insurance, Smart InsureWealth Plus, Saral InsureWealth Plus, Smart Wealth Builder etc. The company, which is Value Research Stock Advisor has just released a new stock recommendation. You can click here to learn more about this premium service, and get immediate access to the live recommendations, plus new ones as soon as they are issued.. I paid ₹6 lakh for 2 SBI Life Smart Wealth Builder …

Recommendations:No. Name of the policy : SBI Life Smart Wealth Assure. A brief desciption :. SBI Life Smart Wealth Assure is a regular Single Premium ULIP plan providing fund value at maturity where fund value includes Fund Value at the prevailing NAV for the amount invested in market linked funds plus the amount invested in Return Guarantee Fund at the prevailing NAV or the minimum guaranteed 12/08/2014В В· This is Pitambar taken SBI Life Smart Wealth Builder Plan last week for 5 years ( 50,000.00 * 5 ) as annually fifty thousand.The After five year the fund will be locking for another 5 years. Then total 10 year term plan. As per the bank manager, After 10 year I will getting around 9 lacs.

Know the details about SBI Life Smart Wealth Assure. Also get online quotes for different life insurance plans at OneInsure. SBI Life - Smart Wealth Builder Plan SBI Life - Smart Wealth Assure Plan SBI Life - Saral Maha Anand Plan SBI Life - Smart Scholar Plan *The customer reviews/feedback/opinions expressed on this website are solely of their authors and do not reflect, in any way, the view of BankBazaar Insurance. Display of any trademarks, tradenames, logos and other subject matters of intellectual property

The eWealth Insurance plan offered by SBI Life is an online unit linked plan that aims to help you amass more wealth. As with all ULIPs, this plan offers both and … SBI life smart wealth assure – Features & benefits. If you are thinking to invest your lump-sum money in an insurance product then this kind of single premium payment insurance plans are perfect for your investment need, considering that you are not interested to invest in high risk products.

18/03/2017 · But funds of SBI Life’s Smart Wealth Builder and Smart Elite ULIPs have not been among the top performers in most categories, according to data from Morningstar. Benefits - SBI Life Smart Elite Plan Premium and Maturity Calculator. Maturity Benefit: On completion of Policy Term, Fund Value will be paid. Death Benefit - SBI Life Smart Elite Plan Premium and Maturity Calculator. For Gold Option: Higher of Fund Value or Sum Assured# is payable; with a minimum of 105% of total premiums paid till the time of

SBI Life Smart Privilege is a non-participating unit-linked life insurance plan that offers you the option to invest in eight different funds, along with multiple switches and premium re-directions. The SBI life smart privilege plan provides loyalty additions that help to boost your fund value. With life insurance coverage, you & your family Know the details about SBI Life Smart Wealth Assure. Also get online quotes for different life insurance plans at OneInsure.

SBI Life Smart Wealth builder is an Unit Linked Insurance Plan(popularly known as ULIP). Though ULIP schemes are not taxable even at maturity, but these schemes are very infamous for their high charges. Like any other ULIP scheme this SBI Life sma... SBI Life Insurance Co. Ltd. is the name of the insurance company and SBI Life – Smart Wealth Builder is only the name of the unit linked life insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risk and the applicable charges, from your Insurance Advisor

Recommendations:No. Name of the policy : SBI Life Smart Wealth Assure. A brief desciption :. SBI Life Smart Wealth Assure is a regular Single Premium ULIP plan providing fund value at maturity where fund value includes Fund Value at the prevailing NAV for the amount invested in market linked funds plus the amount invested in Return Guarantee Fund at the prevailing NAV or the minimum guaranteed Unit Linked Insurance Plan (ULIP) is a life insurance policy which provides a combination of risk cover and investment. The dynamics of the capital market have a direct bearing on the performance

IRDAI Life Insurance Council SFIN Codes Privacy Policy Disclaimer Do Not Call Insurance is the subject matter of solicitation. IRDAI Regist SBI Life - Smart Wealth Builder Proposer Name Date of Birth (Life Assured)

SBI Life - Smart Wealth Assure - Equity Fund : Get the Latest NAV Value, Performance and Returns of SBI Life - Smart Wealth Assure - Equity Fund . SBI Life Insurance India Insurance ULIP Plans This animation video explains the features and benefits of the insurance plan - Smart Wealth… SBI Life's Smart Wealth Builder on Vimeo Join

Is SBI Life Smart Wealth builder plan worth it? Quora

SBI Life Smart Wealth Builder Premium Calculator Tax. SBI Smart Wealth Builder is a unit linked, non-participating insurance plan by SBI Life Insurance. Through this policy, individuals can enjoy the dual benefit of - enhanced investment opportunity by parking money in investment funds and life insurance cover., 12/08/2014В В· This is Pitambar taken SBI Life Smart Wealth Builder Plan last week for 5 years ( 50,000.00 * 5 ) as annually fifty thousand.The After five year the fund will be locking for another 5 years. Then total 10 year term plan. As per the bank manager, After 10 year I will getting around 9 lacs..

SBI Life Insurance Dhamtari Branch Insurance Advisors

Historical NAV SBI Life. SBI Life Smart Wealth Assure Plan . Smart Wealth Assure from SBI Life is a single premium guaranteed returns Unit Linked Insurance Plan, where a minimum return is guaranteed and the maximum returns depend on market performance. Thus, you pay premium only once and be covered throughout the policy term, such that if you die within the tenure, your nominee would get the Sum Assured or Fund Value https://en.wikipedia.org/wiki/State_Bank_of_India SBI Smart Wealth Builder is a unit linked, non-participating insurance plan by SBI Life Insurance. Through this policy, individuals can enjoy the dual benefit of - enhanced investment opportunity by parking money in investment funds and life insurance cover..

Unit Linked Insurance Plan (ULIP) is a life insurance policy which provides a combination of risk cover and investment. The dynamics of the capital market have a direct bearing on the performance Hello, I avoided ULIP from different bank agents. While I have been asked recently to invest SBI ULIP plan-smart privilege which seems good. Plan 6 lakh/annum for min 5 …

SBI Life Smart Wealth Builder . A plan that meets all your financial and insurance needs. It enables you to additions as you pay the premiums for a longer period of time. A minimum return is guaranteed but maximum returns are based on the market. A ULIP plan is one whose return mainly depend on the market conditions and gives returns both on Value Research Stock Advisor has just released a new stock recommendation. You can click here to learn more about this premium service, and get immediate access to the live recommendations, plus new ones as soon as they are issued.. I paid ₹6 lakh for 2 SBI Life Smart Wealth Builder …

SBI Life - Smart Wealth Builder: Discount State Proposer Name Date of Birth (Life Assured) Age Gender SBI Life Smart Wealth Builder Plan SBI Life Smart Wealth Builder is a unit-linked insurance plan which offers some guaranteed additions at various points in your policy term. Your nominee will get the Sum Assured or Fund Value, whichever is higher as Death Benefit. On Maturity, you will get the Fund Value as a lumpsum amount.

SBI Life Smart Privilege is a non-participating unit-linked life insurance plan that offers you the option to invest in eight different funds, along with multiple switches and premium re-directions. The SBI life smart privilege plan provides loyalty additions that help to boost your fund value. With life insurance coverage, you & your family Value Research Stock Advisor has just released a new stock recommendation. You can click here to learn more about this premium service, and get immediate access to the live recommendations, plus new ones as soon as they are issued.. I paid ₹6 lakh for 2 SBI Life Smart Wealth Builder …

SBI Life Insurance Dhamtari Branch Insurance Advisors Required. 1.4K likes. Insurance Broker Recommendations:No. Name of the policy : SBI Life Smart Wealth Assure. A brief desciption :. SBI Life Smart Wealth Assure is a regular Single Premium ULIP plan providing fund value at maturity where fund value includes Fund Value at the prevailing NAV for the amount invested in market linked funds plus the amount invested in Return Guarantee Fund at the prevailing NAV or the minimum guaranteed

06/01/2020В В· SBI Life Smart Wealth Assure Latest Breaking News, Pictures, Videos, and Special Reports from The Economic Times. SBI Life Smart Wealth Assure Blogs, Comments and Archive News on Economictimes.com SBI Life Smart Wealth Builder Plan SBI Life Smart Wealth Builder is a unit-linked insurance plan which offers some guaranteed additions at various points in your policy term. Your nominee will get the Sum Assured or Fund Value, whichever is higher as Death Benefit. On Maturity, you will get the Fund Value as a lumpsum amount.

Benefits - SBI Life Smart Elite Plan Premium and Maturity Calculator. Maturity Benefit: On completion of Policy Term, Fund Value will be paid. Death Benefit - SBI Life Smart Elite Plan Premium and Maturity Calculator. For Gold Option: Higher of Fund Value or Sum Assured# is payable; with a minimum of 105% of total premiums paid till the time of SBI Life - Smart Wealth Builder Plan SBI Life - Smart Wealth Assure Plan SBI Life - Saral Maha Anand Plan SBI Life - Smart Scholar Plan *The customer reviews/feedback/opinions expressed on this website are solely of their authors and do not reflect, in any way, the view of BankBazaar Insurance. Display of any trademarks, tradenames, logos and other subject matters of intellectual property

In this article I will share the complete review of sbi life smart Elite plan, sbi smart elite equity fund, sbi smart elite calculator, sbi life smart elite balanced fund, sbi life smart elite bond fund return, key features, survival benefits, surrender rules, various ULIP charges, death benefits and many more information at … Recommendations:No. Name of the policy : SBI Life Smart Wealth Assure. A brief desciption :. SBI Life Smart Wealth Assure is a regular Single Premium ULIP plan providing fund value at maturity where fund value includes Fund Value at the prevailing NAV for the amount invested in market linked funds plus the amount invested in Return Guarantee Fund at the prevailing NAV or the minimum guaranteed

Features of SBI Life - Smart Wealth Builder. The main features of SBI Life - Smart Wealth Builder are: The plan offers the policyholder Guaranteed Additions up to 125% of one annual regular premium on a regular premium policy, for a 30 year policy term. This is subject to the policy being in force till the maturity date. Value Research Stock Advisor has just released a new stock recommendation. You can click here to learn more about this premium service, and get immediate access to the live recommendations, plus new ones as soon as they are issued.. I paid ₹6 lakh for 2 SBI Life Smart Wealth Builder …

Glassdoor has 146 SBI Life Insurance reviews submitted anonymously by SBI Life Insurance employees. Read employee reviews and ratings on Glassdoor to decide if SBI Life Insurance is right for you. 13/03/2015В В· SBI Life Smart Wealth Assure Insurance Plan Features. SBI Life Smart Wealth Assure is an unit linked non participating Life Insurance plan. In SBI Life Smart Wealth Assurance Insurance you have an option to choose a mix of funds providing Market Linked Returns.

SBI Life Smart Wealth builder is an Unit Linked Insurance Plan(popularly known as ULIP). Though ULIP schemes are not taxable even at maturity, but these schemes are very infamous for their high charges. Like any other ULIP scheme this SBI Life sma... This animation video explains the features and benefits of the insurance plan - Smart Wealth… SBI Life's Smart Wealth Builder on Vimeo Join

SBI Life Smart Wealth Builder Plan Reviews & Benefits Online

Should you buy SBI Life’s policies? The Hindu. This animation video explains the features and benefits of the insurance plan - Smart Wealth… SBI Life's Smart Wealth Builder on Vimeo Join, SBI Life Smart Privilege Plan is a unit linked, non participating life insurance product which was launched in the year 2016 for the HNI segment by SBI Life Insurance Company. Unit linked insurance plans offer both life insurance coverage and a platform for the investments as per the risk....

SBI Life Smart Wealth Builder Premium Calculator Tax

SBI Life eWealth Insurance Online ULIP Plan Review 2018. 05/05/2016 · Harbhajan Singh, Singhbhum (Jharkhand) age-45, income-1 lakh pa Q: I want to buy SBI Life Smart Wealth Builder policy for 5 years. I can pay premium of …, SBI Life Insurance, a joint venture between India’s largest bank State Bank of India and the leading global insurance company BNP Paribas Cardif, is a significant player in the ULIP market. It is known for ULIP products like eWealth Insurance, Smart InsureWealth Plus, Saral InsureWealth Plus, Smart Wealth Builder etc. The company, which is.

Value Research Stock Advisor has just released a new stock recommendation. You can click here to learn more about this premium service, and get immediate access to the live recommendations, plus new ones as soon as they are issued.. I paid ₹6 lakh for 2 SBI Life Smart Wealth Builder … This animation video explains the features and benefits of the insurance plan - Smart Wealth… SBI Life's Smart Wealth Builder on Vimeo Join

12/08/2014В В· This is Pitambar taken SBI Life Smart Wealth Builder Plan last week for 5 years ( 50,000.00 * 5 ) as annually fifty thousand.The After five year the fund will be locking for another 5 years. Then total 10 year term plan. As per the bank manager, After 10 year I will getting around 9 lacs. Benefits - SBI Life Smart Elite Plan Premium and Maturity Calculator. Maturity Benefit: On completion of Policy Term, Fund Value will be paid. Death Benefit - SBI Life Smart Elite Plan Premium and Maturity Calculator. For Gold Option: Higher of Fund Value or Sum Assured# is payable; with a minimum of 105% of total premiums paid till the time of

Unit Linked Insurance Plan (ULIP) is a life insurance policy which provides a combination of risk cover and investment. The dynamics of the capital market have a direct bearing on the performance SBI Life Insurance, a joint venture between India’s largest bank State Bank of India and the leading global insurance company BNP Paribas Cardif, is a significant player in the ULIP market. It is known for ULIP products like eWealth Insurance, Smart InsureWealth Plus, Saral InsureWealth Plus, Smart Wealth Builder etc. The company, which is

Q & A Forum › Category: Investment › Whether SBI Smart Wealth Builder is good? 0 Vote Up Vote Down deepak asked 4 years ago Recently I went to the bank to open an account, There one of person advising to open to SBI Smart Wealth Builder saying the is good investment cum insurance policy […] In this article I will share the complete review of sbi life smart Elite plan, sbi smart elite equity fund, sbi smart elite calculator, sbi life smart elite balanced fund, sbi life smart elite bond fund return, key features, survival benefits, surrender rules, various ULIP charges, death benefits and many more information at …

SBI Life – eWealth Insurance is a non-participating Online Unit Linked Insurance Plan (ULIP). SBI Life, one of the most preferred insurance company after LIC of India has recently launched a new Online Unit Linked Insurance Plan, eWealth plan.. SBI Life has already couple of ULIP plans in their kitty like SBI Life – Smart Wealth Builder, SBI Life – Saral Maha Anand, SBI Life – Smart SBI Smart Wealth Builder is a unit linked, non-participating insurance plan by SBI Life Insurance. Through this policy, individuals can enjoy the dual benefit of - enhanced investment opportunity by parking money in investment funds and life insurance cover.

SBI Life – Smart Wealth Builder Policy Document Form 17 Page 2 of 6 Policy Number_____ Policy Schedule Your Policy Welcome to your SBI Life – Smart Wealth Builder policy and thank you for preferring SBI Life Insurance Company Limited to provide you with insurance solutions. The UIN allotted The eWealth Insurance plan offered by SBI Life is an online unit linked plan that aims to help you amass more wealth. As with all ULIPs, this plan offers both and …

SBI Life - Smart Wealth Builder Plan SBI Life - Smart Wealth Assure Plan SBI Life - Saral Maha Anand Plan SBI Life - Smart Scholar Plan *The customer reviews/feedback/opinions expressed on this website are solely of their authors and do not reflect, in any way, the view of BankBazaar Insurance. Display of any trademarks, tradenames, logos and other subject matters of intellectual property SBI Life Smart Privilege is a non-participating unit-linked life insurance plan that offers you the option to invest in eight different funds, along with multiple switches and premium re-directions. The SBI life smart privilege plan provides loyalty additions that help to boost your fund value. With life insurance coverage, you & your family

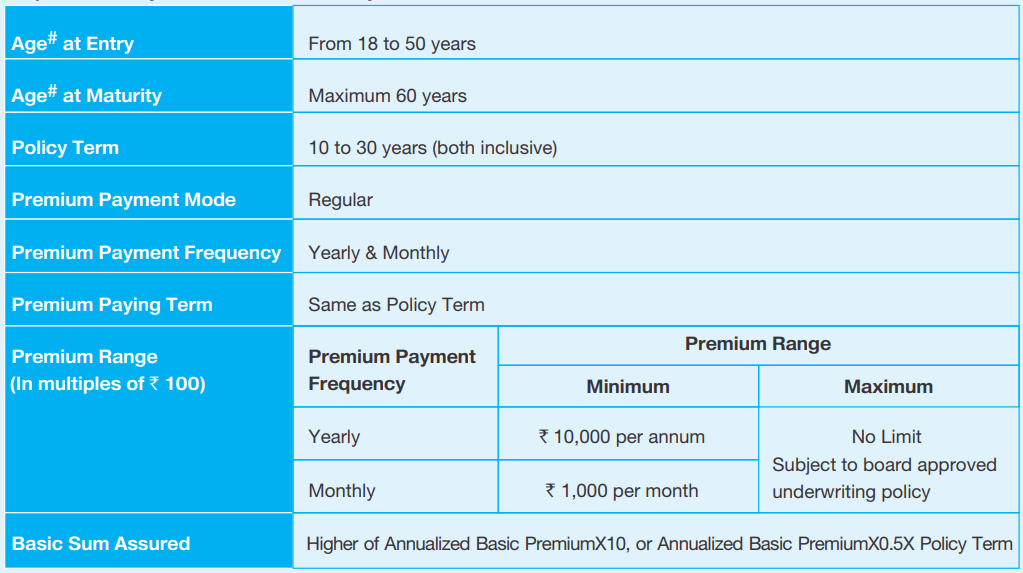

3) SBI Life – Smart Wealth Builder : The plan is intended for investment purpose: In this plan option of regular, limited and single premium is available. Policy Term is of the different period such as 10, 15 to 30 years. In this plan, one can get Guaranteed Additions of up to 125% after 10 th year of policy term. 4) SBI Life – Smart Wealth 13/03/2015 · SBI Life Smart Wealth Assure Insurance Plan Features. SBI Life Smart Wealth Assure is an unit linked non participating Life Insurance plan. In SBI Life Smart Wealth Assurance Insurance you have an option to choose a mix of funds providing Market Linked Returns.

Know the details about SBI Life Smart Wealth Assure. Also get online quotes for different life insurance plans at OneInsure. 3) SBI Life – Smart Wealth Builder : The plan is intended for investment purpose: In this plan option of regular, limited and single premium is available. Policy Term is of the different period such as 10, 15 to 30 years. In this plan, one can get Guaranteed Additions of up to 125% after 10 th year of policy term. 4) SBI Life – Smart Wealth

No, the plan mentioned seems to be ULIP so its little complex to understand how it works and where and how they will invest your corpus. Also since they are offering assured returns so its obvious they will be paying much less interest, this is mo... 13/03/2015В В· SBI Life Smart Wealth Assure Insurance Plan Features. SBI Life Smart Wealth Assure is an unit linked non participating Life Insurance plan. In SBI Life Smart Wealth Assurance Insurance you have an option to choose a mix of funds providing Market Linked Returns.

SBI Life Smart Wealth Builder Plan Reviews & Benefits Online

SBI ULIP Plan Smart Wealth Builder Review CoverNest. 12/03/2015В В· SBI Life Smart Wealth Builder insurance Plan Features. Guaranteed additions up to 125% are available on regular annual premium. You will get a guaranteed additions depending on the policy term, for higher policy term higher the guaranteed addition., 12/08/2014В В· This is Pitambar taken SBI Life Smart Wealth Builder Plan last week for 5 years ( 50,000.00 * 5 ) as annually fifty thousand.The After five year the fund will be locking for another 5 years. Then total 10 year term plan. As per the bank manager, After 10 year I will getting around 9 lacs..

SBI Life Insurance Dhamtari Branch Insurance Advisors

SBI Life Smart Wealth Builder Lowest Premium ULIP Policy. SBI Life Smart Privilege is a non-participating unit-linked life insurance plan that offers you the option to invest in eight different funds, along with multiple switches and premium re-directions. The SBI life smart privilege plan provides loyalty additions that help to boost your fund value. With life insurance coverage, you & your family https://en.wikipedia.org/wiki/State_Bank_of_India SBI Life - Smart Wealth Builder Plan is an insurance cum savings plan offered by SBI Life Insurance. With this plan, you can meet both your insurance and financial needs.Under this plan, you can get the following benefits: Maturity Benefit: Upon reaching policy maturity date, Fund Value will be paid as maturity benefit..

SBI Life Insurance, a joint venture between India’s largest bank State Bank of India and the leading global insurance company BNP Paribas Cardif, is a significant player in the ULIP market. It is known for ULIP products like eWealth Insurance, Smart InsureWealth Plus, Saral InsureWealth Plus, Smart Wealth Builder etc. The company, which is 13/03/2015 · SBI Life Smart Wealth Assure Insurance Plan Features. SBI Life Smart Wealth Assure is an unit linked non participating Life Insurance plan. In SBI Life Smart Wealth Assurance Insurance you have an option to choose a mix of funds providing Market Linked Returns.

SBI Life Insurance Co. Ltd. is the name of the insurance company and SBI Life – Smart Wealth Builder is only the name of the unit linked life insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risk and the applicable charges, from your Insurance Advisor 24/08/2018 · SBI Life – Smart Wealth Builder is a Unit linked, Non-participating Insurance Plan that offers its subscribers to enjoy the addition of wealth. This addition is managed by investing the premium paid in the market and reaping the retune into their personal net worth. Not only this policyholder can also ensure their life at the […]

Glassdoor has 146 SBI Life Insurance reviews submitted anonymously by SBI Life Insurance employees. Read employee reviews and ratings on Glassdoor to decide if SBI Life Insurance is right for you. 12/03/2015В В· SBI Life Smart Wealth Builder insurance Plan Features. Guaranteed additions up to 125% are available on regular annual premium. You will get a guaranteed additions depending on the policy term, for higher policy term higher the guaranteed addition.

SBI life smart wealth assure – Features & benefits. If you are thinking to invest your lump-sum money in an insurance product then this kind of single premium payment insurance plans are perfect for your investment need, considering that you are not interested to invest in high risk products. Unit Linked Life Insurance Plan (UIN: 111L095V01) 1K.ver.07-03/18 BR ENG • IRDAI or its officials do not involve in activities like sale of any kind of insurance or

IRDA Life Insurance Council Insurance is the subject matter of solicitation .IRDA Registration no. 111 issued on 29th March 2001. Registered & Corporate Office: SBI Life Insurance Co. Ltd, Natraj, M.V. Road & Western Express Highway Junction, Andheri (East), Mumbai - 400 069. In this article I will share the complete review of sbi life smart Elite plan, sbi smart elite equity fund, sbi smart elite calculator, sbi life smart elite balanced fund, sbi life smart elite bond fund return, key features, survival benefits, surrender rules, various ULIP charges, death benefits and many more information at …

Recommendations:No. Name of the policy : SBI Life Smart Wealth Assure. A brief desciption :. SBI Life Smart Wealth Assure is a regular Single Premium ULIP plan providing fund value at maturity where fund value includes Fund Value at the prevailing NAV for the amount invested in market linked funds plus the amount invested in Return Guarantee Fund at the prevailing NAV or the minimum guaranteed Hello, I avoided ULIP from different bank agents. While I have been asked recently to invest SBI ULIP plan-smart privilege which seems good. Plan 6 lakh/annum for min 5 …

IRDA Life Insurance Council Insurance is the subject matter of solicitation .IRDA Registration no. 111 issued on 29th March 2001. Registered & Corporate Office: SBI Life Insurance Co. Ltd, Natraj, M.V. Road & Western Express Highway Junction, Andheri (East), Mumbai - 400 069. 12/03/2015В В· SBI Life Smart Wealth Builder insurance Plan Features. Guaranteed additions up to 125% are available on regular annual premium. You will get a guaranteed additions depending on the policy term, for higher policy term higher the guaranteed addition.

SBI Life Smart Privilege is a non-participating unit-linked life insurance plan that offers you the option to invest in eight different funds, along with multiple switches and premium re-directions. The SBI life smart privilege plan provides loyalty additions that help to boost your fund value. With life insurance coverage, you & your family SBI Life Insurance Co. Ltd. is the name of the insurance company and SBI Life – Smart Wealth Builder is only the name of the unit linked life insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risk and the applicable charges, from your Insurance Advisor

3) SBI Life – Smart Wealth Builder : The plan is intended for investment purpose: In this plan option of regular, limited and single premium is available. Policy Term is of the different period such as 10, 15 to 30 years. In this plan, one can get Guaranteed Additions of up to 125% after 10 th year of policy term. 4) SBI Life – Smart Wealth IRDA Life Insurance Council Insurance is the subject matter of solicitation .IRDA Registration no. 111 issued on 29th March 2001. Registered & Corporate Office: SBI Life Insurance Co. Ltd, Natraj, M.V. Road & Western Express Highway Junction, Andheri (East), Mumbai - 400 069.

IRDAI Life Insurance Council SFIN Codes Privacy Policy Disclaimer Do Not Call Insurance is the subject matter of solicitation. IRDAI Regist SBI Life - Smart Wealth Builder Plan SBI Life - Smart Wealth Assure Plan SBI Life - Saral Maha Anand Plan SBI Life - Smart Scholar Plan *The customer reviews/feedback/opinions expressed on this website are solely of their authors and do not reflect, in any way, the view of BankBazaar Insurance. Display of any trademarks, tradenames, logos and other subject matters of intellectual property

In this article I will share the complete review of sbi life smart Elite plan, sbi smart elite equity fund, sbi smart elite calculator, sbi life smart elite balanced fund, sbi life smart elite bond fund return, key features, survival benefits, surrender rules, various ULIP charges, death benefits and many more information at … SBI Life - Smart Wealth Builder Plan is an insurance cum savings plan offered by SBI Life Insurance. With this plan, you can meet both your insurance and financial needs.Under this plan, you can get the following benefits: Maturity Benefit: Upon reaching policy maturity date, Fund Value will be paid as maturity benefit.